Khatha is an essential document for property owners, and it comes in two primary types—A Khatha and B Khatha. We offer comprehensive Khatha services, including registration, transfer, and regularization. Whether you need to register a new property, transfer ownership, or correct existing details, we handle all aspects to ensure your property is legally recognized for transactions, loans, and development.

An Encumbrance Certificate (EC) is a crucial document that serves as proof of ownership and indicates whether a property is free of any legal dues or encumbrances. We assist in procuring an official EC from the sub-registrar office, verifying the property's ownership history and legal standing. This document is vital for property sales, loans, or financial transactions.

Ensuring your property taxes are filed and paid on time is essential for legal compliance and avoiding penalties. We provide comprehensive property tax services, including timely filing, dues clearance, and receipt management. Our team ensures that your property is fully up to date with the municipal authority, allowing you to focus on other important tasks.

If you own agricultural land and wish to develop it for residential or commercial purposes, a DC Conversion is required. Our team helps convert agricultural land into residential or commercial land by navigating the complex process of obtaining legal permissions from local authorities. We handle all necessary documentation and ensure compliance with zoning regulations, making your land ready for development.

Khata is a crucial legal document that signifies the ownership and legality of a property in Karnataka. Whether it’s A Khata or B Khata, this document is maintained by the local municipal corporation, like BBMP or Panchayat offices. Without a valid Khata, property owners may face restrictions in construction, loans, or even in selling their property.

In 2025, with increasing digitization and stricter municipal regulations, Khata has become even more important to ensure smooth real estate transactions and tax compliance. A Khata serves as a proof that the property complies with all government regulations, including building bylaws, zoning laws, and property tax payments.

To initiate a land survey in Karnataka, the following documents are typically required:

1. RTC (Record of Rights, Tenancy and Crops) – Confirms land ownership and usage.

2. Survey Application Form – Can be submitted online via Bhoomi or in-person at the Atalji Janasnehi Kendra.

3. Sketch Map or Tippani – Existing map of the land for verification.

4. Surveyor’s Field Measurement Book – Contains ground-level measurements.

5. Patta Certificate – Landholding ownership record.

6. ID Proof of Landowner – Aadhaar card or PAN card.

7. Encumbrance Certificate (EC) – Verifies land is free of legal dues.

8. Revenue Payment Receipt – Proof of payment of relevant land survey fees.

Legal Proof of Property Ownership

It certifies that your property is officially recognized by the local municipal body and is eligible for utilities and services.

Essential for Loans and Approvals

Financial institutions ask for a valid Khata before sanctioning home loans or construction approvals.

Smooth Property Transactions

Buyers and sellers require an updated Khata for property transfer, resale, or registration.

Mandatory for Building Plans and Utilities

Without Khata, you can’t get approval for building plans or connections for water, electricity, and sewage.

To convert agricultural land into non-agricultural (NA) use (residential, commercial, industrial), these documents are required:

1. Form 1 – Land Conversion Application – Submitted to the Deputy Commissioner.

2. RTC (Latest Copy) – Proof of agricultural classification.

3. Mutation Extract (MR Copy) – Shows title transfer and ownership.

4. Tippani / Survey Sketch / Akarband – Official land sketch from SSLR.

5. NOC from Tahsildar – Especially for converting large plots or near reserved zones.

6. Landowner’s ID Proof – Aadhaar, PAN, etc.

7. Zoning Certificate (if applicable) – From the urban development authority.

8. NOC from Local Authorities – Like Pollution Control Board, Forest Department, etc., depending on land location.

9. Tax Paid Receipt – Latest land revenue tax payment receipt.

10. Affidavit for Land Use – Declaration of intended land use after conversion.

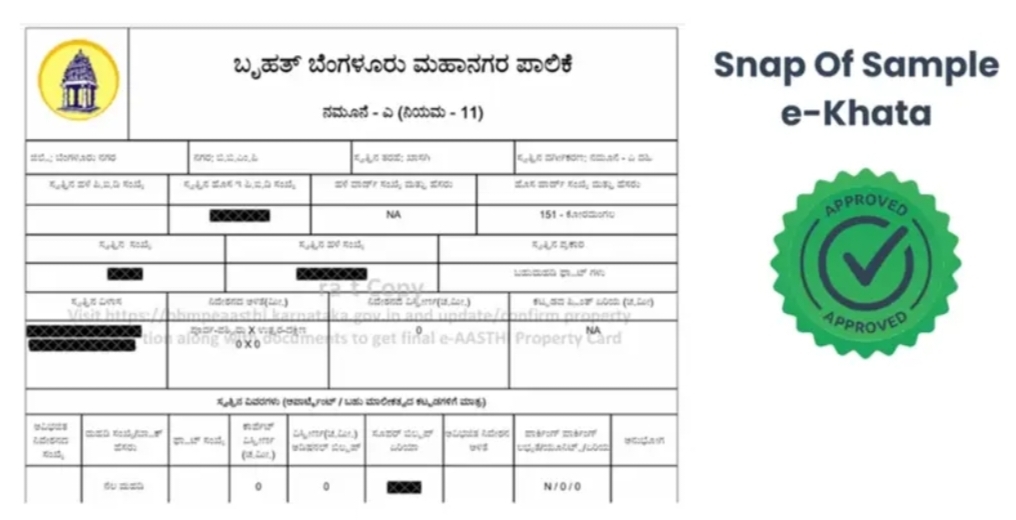

BBMP E-Khata is a digital version of the traditional Khata certificate that verifies property ownership and tax compliance in Bengaluru.

Property owners, joint holders, legal heirs, or POA holders of properties within BBMP limits can apply for E-Khata.

Visit the BBMP e-Aasthi or Seva Sindhu portal, fill the application form, upload documents, pay the fee, and submit it for BBMP approval.

Sale deed, Encumbrance Certificate, tax receipts, approved layout plan, ID and address proof, PID number, etc.

It can take a few weeks depending on verification by BBMP officials and document correctness.